Ethereum has seen an unprecedented rise in 2025 driven by the high transaction volumes, massive ETF inflows as well as strong DeFi activity. Being the second-largest crypto by market cap in terms of the market capitalization, Ethereum buzzes with renewed energy, which is indicative of its importance to the crypto world.

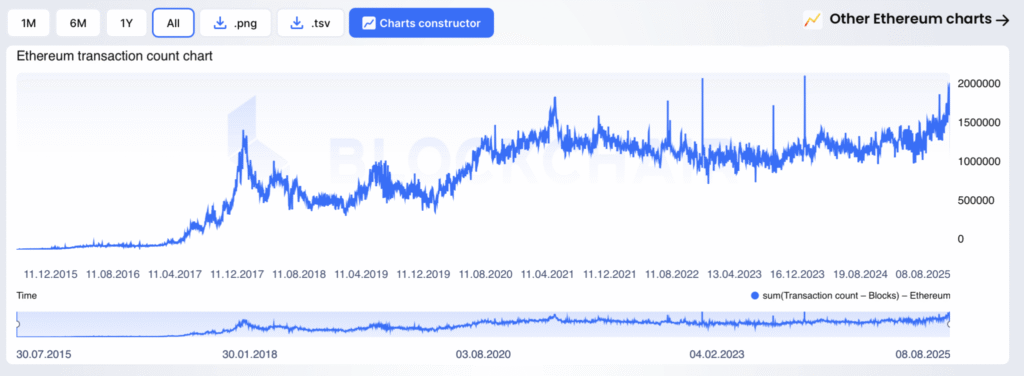

The blockchain of Ethereum is experiencing record transaction volumes with 1.87 million transactions made on August 5, 2025, nearly the all-time high of 1.96 million on January 2024. Etherscan statistics indicate the increased activity in stablecoins, especially USDT and USDC, and the Uniswap handles almost $1 billion in trading volume daily. This on-chain surge has been catalyzed by the GENIUS Act which gives U.S. regulatory clarity to stablecoins. The active addresses have also reached a 12-month high of 931,310, indicating substantial activity in the DeFi, non-fungible tokens (NFTs) and layer-2 solutions, such as Polygon and Base.

Read also: ICICI’s ₹50,000 Minimum Balance Rule Triggers Boycott Calls Online

The DeFi ecosystem on Ethereum has dominated the industry with a total value locked stand at 186 billion, composing 59 percent of the DeFi sector. The Uniswap has a 22 percent stake in the decentralized exchange realm, and the stablecoin offering of Ethereum is in the lead at 130 billion. The GENIUS Act has also catalyzed the adoption of stablecoins, and layer-2 solutions help improve scalability, allowing more meme coins to be traded and tokens to be minted.

The selling pressure is also being decreased by whale accumulation, and investors such as the so-called 0x35fb took 88,292 ETH ($298.26 million) out of exchanges. The ETH held in exchanges has dropped to 15.6 million the lowest since 2017, showing that ETH is going towards long-term holding. Ethereum has a price of about 3,670 dollars with a high of 3,848 dollars in 2025. Technical signs, such as a bull flag pattern and bullish MACD cross, indicate a possible increase to the level of $5,000, and the support is at $3,200 3,400.

Although this is making gains, gas prices are increasing and macroeconomic changes in 2026 may be a problem. Nevertheless, strong network effects, institutional support, and DeFi dominance cement the status of Ethereum as the backbone of the crypto market with potential to grow steadily.

Source: Etherscan, DappRadar, BlackRock iShares Ethereum Trust, Fidelity FETH, Grayscale Ethereum Mini Trust, X posts (July-August 2025), GENIUS Act documentation, CoinMarketCap, TradingView.

Leave a Reply