Introduction

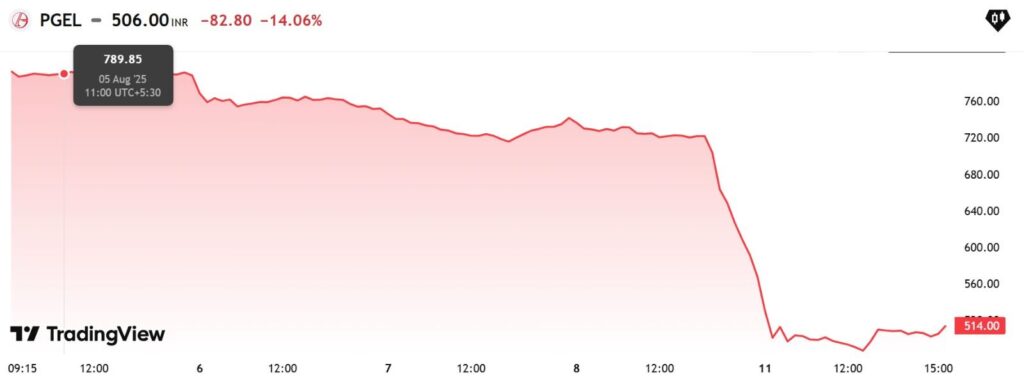

PG Electroplast, a prominent firm in the plastic and polymer production industry, has experienced a slump in its stock price, a four-day downward run which finally ended in a 35 percent fall in its recent high levels.

Nevertheless, having reached such lows, the stock has demonstrated certain signs of slight recovery, which activated the interest of investors and market observers again. The paper will give an in-depth report of the current trend of the stock, examine the reasons that have caused the price movement, and give a view of what investors ought to take into account in the future.

Read also: Understanding JSW Cement IPO GMP Grey Market Premium and Its Impact on Investors

Quick Summary

PG Electroplast stock fell on four consecutive trading days with a loss of about 35 percent. However, following a low point, there was a slight recovery on the stock in an indication of stabilization. Highlights are:

- Losing streak: The market fluctuated and the stock price declined largely due to sector-related issues.

- General depreciation: A loss of about 35 percent of the share prices in the course of this time.

- Minor recovery: Over the past trading sessions, there was a slight recovery that came out of the lowest levels.

- Investor caution: Investors are advised to do proper analysis of the market before an investment decision is made, since there are uncertainties in the market.

Main Content

What is the Four-Day Slide in PG Electroplast Shares?

A number of factors can be identified as the cause of the recent decline in the shares of PG Electroplast. The first factor was the macroeconomic uncertainty that led to volatility in the wider stock market because of inflation fears, interest rate increases, and geopolitical tensions that affected investor sentiment across sectors.

Also, the plastic manufacturing sector has been facing pressure on the price of raw materials, supply chain losses, and demand trends of the final user industries such as the automotive and consumer goods sectors. PG Electroplast, which was closely connected with these industries, suffered the worst effect of this uncertainty.

Additionally, factors that were specific to the company might have played a role. There are times when investors respond severely to quarterly earnings releases, management commentary or news of regulatory issues or growth strategies. The selling pressure can be created by any perceived bad news or lack of strong guidance.

In that regard, the four-days of losses shown by PG Electroplast imply that there was an influx of selling as investors reevaluated the short-term outlook of the stock under unfavorable circumstances.

Read also: DOMS Industries Share Price Jumps 12% to 11-Week High After Q1 Results. Should You Buy?

What is Meant by Signs of Minor Recovery?

Having reached its bottom in the context of such a decline, the shares of PG Electroplast began to experience some minor improvements. It is not unusual to get this kind of rebound in the stock markets particularly following a sharp sell off.

A number of factors may be behind the recovery:

Value buying: There are investors and traders who regard a dip as a chance to purchase the stock at a low price, with the hope that the price will stabilize or improve.

Good News or disclosure: There are also cases when a company makes an update or clarification which dispels the fears in the market and the market reinterests in buying.

Technical factors: Technical traders will get an indication that the stock will hit a support level and buy because of chart patterns.

Although this small recovery is a positive sign of a recovery, it is necessary to mention that these rebounds can prove short-lived unless the problems leading to them are addressed.

What are the Investors to Do Now?

The

ambiguous nature of the stock market of PG Electroplast provides a word of

caution to existing and potential investors. The following are some of the

points that can be considered:

1. Study Company Basics

Don t just see the movement of price but check the health of the company. Look at

quarterly performance, sales, profitability ratios, debt ratios and cash flow.

Even when it is volatile, a robust balance sheet and steady growth in earnings

can give confidence.

2. Industry Outlook

Evaluate the trends in the plastic manufacturing industry, such as the trend in the

prices of raw materials, the demand projection in the large sectors such as the

automotive and appliances and the effect of the regulations on the use of

plastics. Stock recovery can be facilitated by a positive industry environment.

3. Technical Analysis

The chart analysis will be able to determine the probable support and resistance

levels, moving averages, and volume patterns. These signs might give

information about whether the existing recovery is robust or it will fail.

4. Keep up-to-date with the News

Monitor any corporate news, policy-related developments or market news that might influence the stock. Information about what is happening in the market is also essential to make changes to your investment strategy in time.

5. Risk Management

Considering the volatility that has been experienced in the stocks, make sure that the level of investment is within your comfort of risk. One of the ways to reduce

downside risks is diversifying your portfolio and establishing stop-loss

levels.

The Possible Scenarios of the Shares of PG Electroplast

- Scenario 1 Sustained Recovery The stock may continue to recover and even reach past highs in case PG Electroplast records good earnings, increases operational efficiencies or experiences good industry trends.

- Scenario 2: Remaining Volatility In case macroeconomic or industry issues are persistent, and in case the firm has an operational problem, the shares may continue to be volatile and the share price may alternate.

- Scenario 3: Decline even More In the worst-case scenario, in case of the adverse news or the poor earnings persistence, the stock may be under pressure on the downside.

Why did PG Electroplast shares experience a four-day losing streak?

The decline was driven by a combination of broader market volatility, industry-specific challenges, and possibly company-related factors like earnings performance or investor sentiment.

What caused the recent minor recovery in PG Electroplast shares?

The recovery may be due to value buying, technical support levels, or any positive updates that restored some investor confidence.

Is it a good time to invest in PG Electroplast?

Investment decisions should be based on detailed fundamental and technical analysis along with your personal risk tolerance.

How much has PG Electroplast’s share price declined during the four-day

The stock lost approximately 35% of its value during this period.

What should investors watch out for in the coming days?

Investors should monitor company announcements, quarterly results, raw material price trends, and overall market sentiment for guidance.

Conclusion

The share price at PG Electroplast has been very volatile, a losing streak of four days erased approximately 35 percent of the stock value and then it started rising slightly, which could suggest a stabilization. Although this recovery is good, investors need to remain careful and use the full analysis in their decision making. Being aware of the company performance, industry trends and market conditions will be the important factors in this unclear period of time.

Disclaimer:This article is for information only and not financial advice. Please do your own research or consult a financial expert before investing. The author is not responsible for any losses.

Leave a Reply to JSW Cement IPO GMP Grey Market Premium 2025 – Cancel reply